Premium Tax Subsidies

Health Care Costs and Getting Help Paying for Coverage

At Covered California, you can find affordable health insurance that meets your needs and budget. You can shop online, in person or by phone and compare different health insurance plans, as well as learn whether you qualify for financial help, such as federal tax credits to reduce your monthly premium costs.

Health insurance premiums through Covered California are based on an enrollee’s age, where they live (their ZIP code), their household size, their projected household income, and the health plan and benefit level they select. Premiums are not determined by pre-existing conditions. That means health insurance plans offered through Covered California cannot charge a person more or refuse to cover someone because they have a pre-existing health condition.

You can use Covered California’s online Shop and Compare Tool to see how much health insurance plans in your area cost and to find out whether you are likely eligible for financial assistance. You can also find out whether you qualify for free or low-cost health coverage through Medi-Cal.

To read more about getting financial help paying for your insurance premium and other costs associated with using health care, click on the topic headings below.

Financial Help: Premium Assistance and Cost-Sharing Reductions

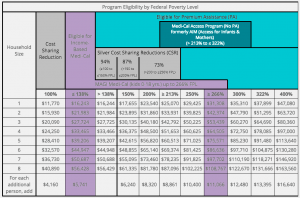

Covered California offers two main types of help to pay for coverage: premium assistance and cost-sharing subsidies.

- Premium assistance is a tax credit (formally called the Advanced Premium Tax Credit, or APTC) to reduce a person’s monthly premium cost.

- Cost-sharing reductions are subsidies to reduce an individual’s out-of-pocket costs (their copays, coinsurance, deductible and out-of-pocket maximum).

Premium Assistance

Premium assistance to help reduce the cost of health care is available to individuals and families who enroll in a Covered California health insurance plan and meet certain income requirements.

Even though premium assistance is a tax credit, it is available to eligible consumers whether or not they have filed taxes for the previous year. However, to receive it, individuals must confirm that they will file taxes for the year that they will be enrolled in a Covered California plan and will be receiving the premium assistance. It is only available for health plans purchased through Covered California or other federally operated or state-operated marketplaces. To be eligible for premium assistance, an individual must:

- Be a U.S. citizen, a U.S. national or a lawfully present immigrant buying coverage through Covered California.

- Have an annual household income between 138 percent and 400 percent* of the federal poverty level (FPL). Estimate your FPL here.

- Not be eligible for other public health coverage** — including full-scope Medi-Cal, premium-free Medicare Part A or military coverage.

- Not have access to affordable, minimum-value health insurance through an employer.***